As one of three critical financial statements of any business (the others being the balance sheet and cash flow statement), an income statement helps you understand the financial health of your business. Because of just how important it is, in case you don’t know what and how, we’re here to tell you everything you need to know about income statements, how to calculate it and even give you some examples on what it looks like..

What is an income statement?

An income statement is a financial report detailing a business’ income and expenses (like investments you’d highlight in IRRs), profits and losses, over a particular period of time. It’s used in both corporate finance and accounting.

It’s also a useful management tool to help manage and strategize your company and tells your investors, lenders, partners and readers about your financial performance and profitability. Decisions made based on your income statement can really affect your company’s future – to make or break your brand.

Major components of an income statement

Income statements are made up of several main parts:

1. Sales revenue

The amount of money your business has gained through its main income stream and primary operations.

2. Cost of Goods Sold (COGS)

Also known as cost of sales, this is the total cost of everything that goes into making/offering your products/services.

3. Gross profit

Sometimes called gross margin or contribution margin, gross profit is your revenue minus COGS.

4. Operating expenses

All indirect costs of running a business goes under here, which could include things like rent, marketing, advertising, office supplies, maintenance, insurance, employee benefits, accounting fees, legal fees, and taxes.

5. Earning Before Tax (EBT) income

The amount of money that’s left after subtracting all expenses and losses from all your revenue and gains.

6. Depreciation and amortization expense

Value lost by assets over time and are created by accountants to spread out the cost of capital assets.

7. Interest Expenses

Commonly, this comes about when your company acquires debt, borrowing money and leasing.

8. Other expenses

Every industry a business falls under usually has its own unique set of expenses like fulfillments, technology, research and development, stock-based compensation, foreign exchange impacts, etc.

9. Income taxes

This is fairly self explanatory; referring to the taxes you’re charged and can consist of both current and future taxes.

10. Net income

The amount of money left over after subtracting income taxes from EBT.

The uses of an income statement

An income statement is a useful document for multiple reasons:

-

It provides details on a company’s business activities and profitability to stakeholders and these detailed insights are useful for comparisons across different sectors and businesses

-

Management can make decisions on expansion, new audience targeting, pushing sales, increasing production, or closing a product line or department

-

Important for strategic planning, budgeting and financial forecasts and also quickly identify problem areas and compare finances with the company’s targets, budgets and projections

-

Lenders, investors and other partners use it to understand your business and its health

-

Income statements are also useful for annual tax filing assessments.

Basic formula for income statement

The most basic calculation for an income statement is simply:

Net Income = (Revenues + Gains) – (Expenses + Losses)

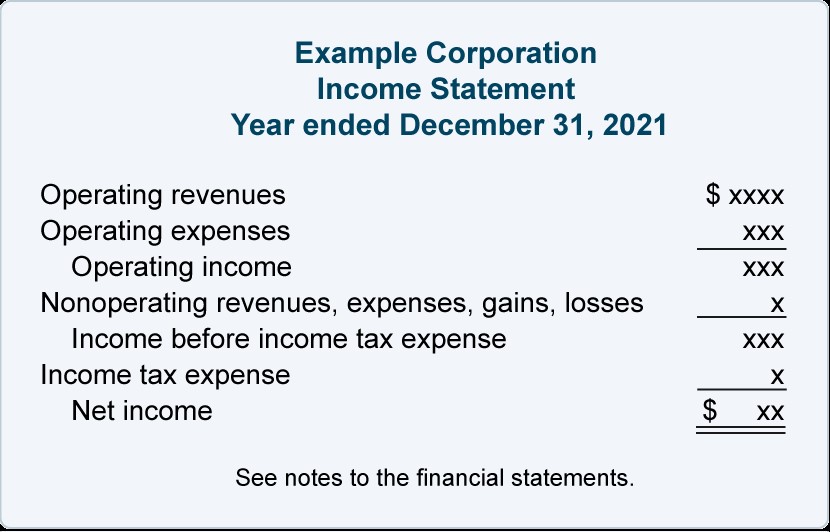

This formula is for what’s known as a single-step income statement.

There is also a multi-step income statement which separates operational revenues and expenses from the non-operational ones and calculators the net income through a three-step process:

Gross Profit= Net Sales – Cost of Goods Sold

Operating income = Gross Profit – Operating Expense

Net Income = Operating Income + Non Operating Items

Income statement examples

Your income statement can be organized to look something like this:

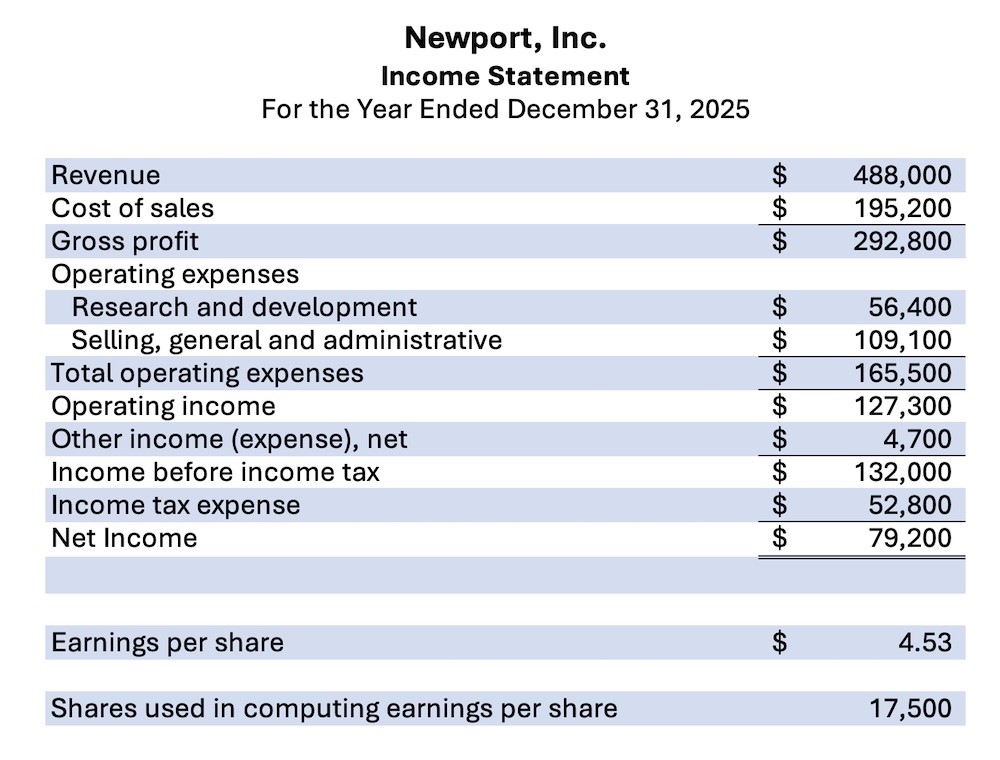

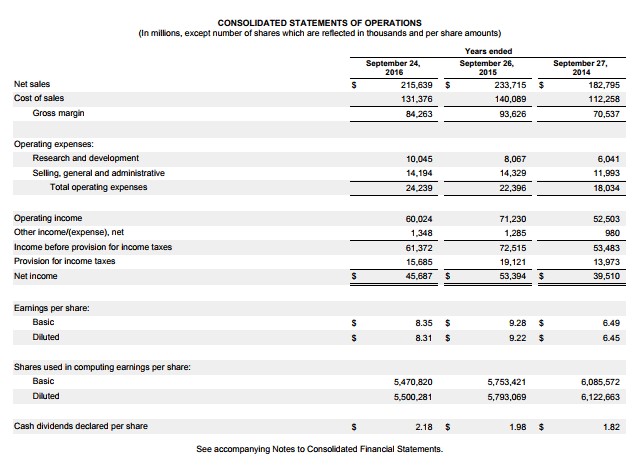

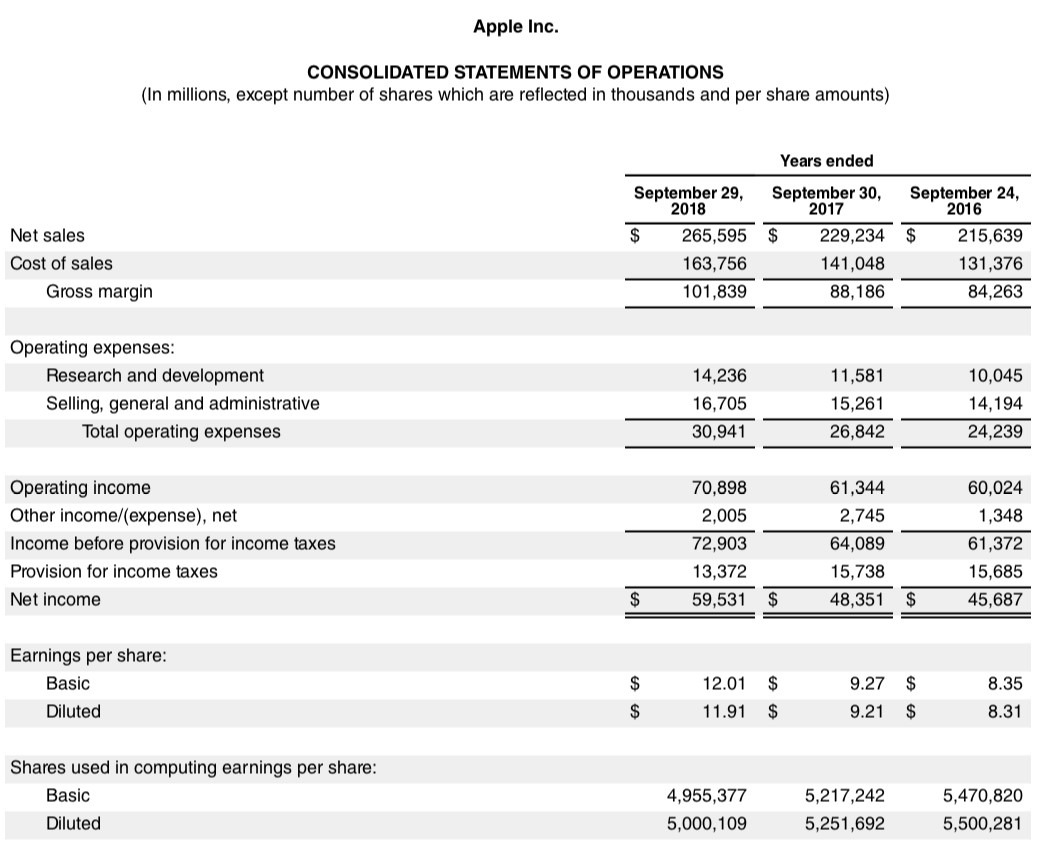

And a complete income statement could look similar to these:

Keeping your business on track

As mentioned before, your income statement is a useful tool to help you navigate and steer your business toward your goals and aims. Income statements are also there to give a prospect of confidence for your investors that you are a worthy investment opportunity and a great partner to work with, especially as you show that you know what you’re doing and maximizing your profits correctly.

ALL THE BEST. GOOD LUCK. & STAY SAFE!

Leave a Comment